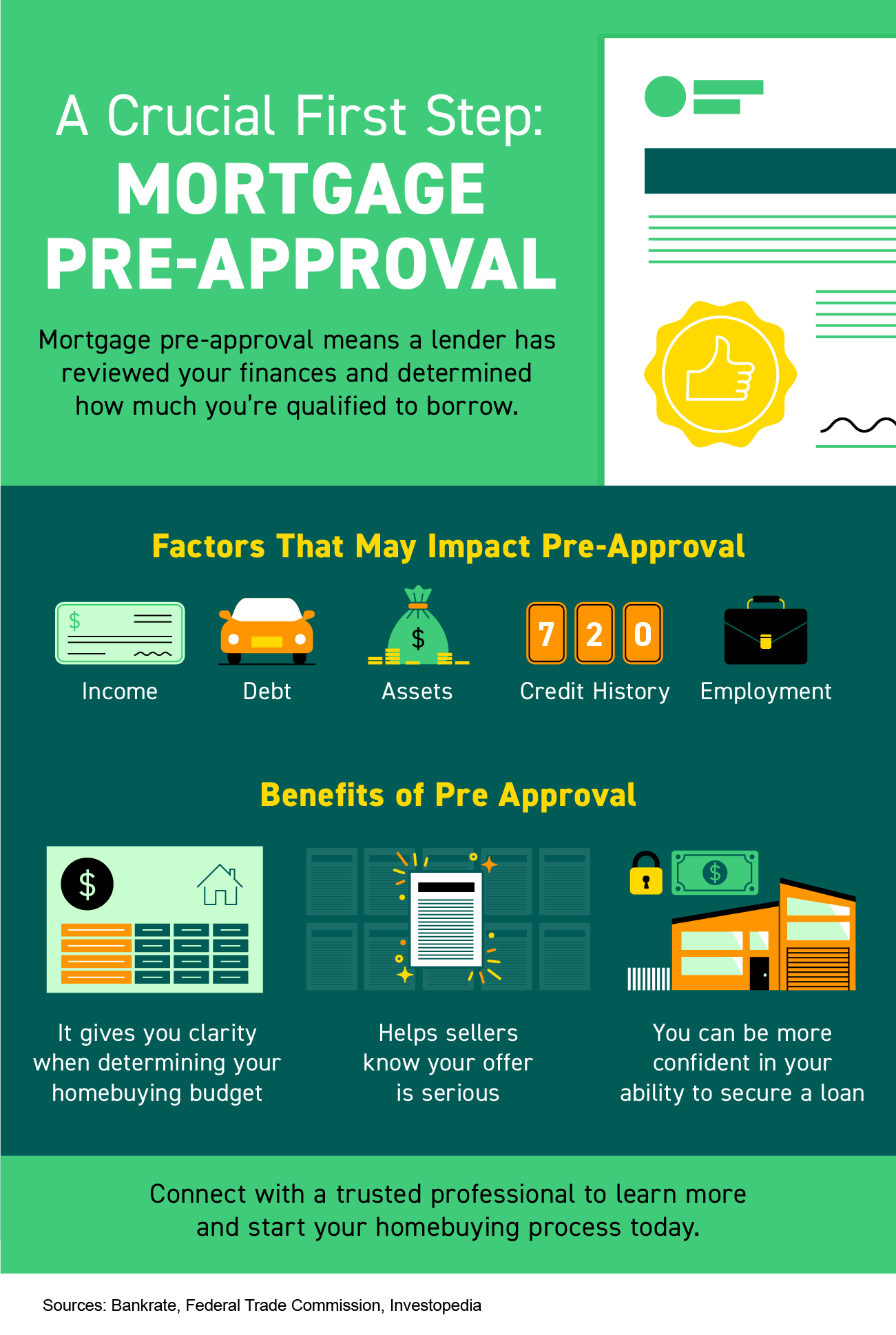

When you first begin the home buying process, the first step is getting pre approved for a mortgage loan.

Once you are preapproved, you will know your budget, including what the down payment and monthly payment will be. A pre-approval also shows the seller that you are ready to move forward with your purchase. The pre-approval process also means that as a consumer, you are confident in your ability to borrow money to purchase a home.

A mortgage pre-approval is where a lender reviews your finances and, based on factors like your income, debt, and credit history, determins how much you’re qualified to borrow.

Being pre-approved for a loan can provide confidence in your ability to secure a loan, and helps sellers know your offer is serious.

Connect with a trusted professional to learn more and start your homebuying process today. Are you open minded to a mortgage broker referral? Reach out to The Svelling Group and we can connect you with a trustworthy lending partner.

![A Crucial First Step: Mortgage Pre-Approval [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/09/15085222/20220916-MEM-1046x1558.png)