Homeowners and property sellers in San Diego County may soon face a significant change to real estate transaction costs. County officials are exploring a proposal that would substantially increase the local real estate transfer tax, which is paid when a property is sold.

This article explains what the proposed transfer tax increase is, how it would work, and what it could mean for homeowners in Jamul and throughout San Diego County, based on publicly reported information and current policy discussions.

What Is a Real Estate Transfer Tax?

A real estate transfer tax is a fee charged when ownership of a property changes hands. In most cases, it is paid by the seller at the close of escrow, although this can vary by agreement.

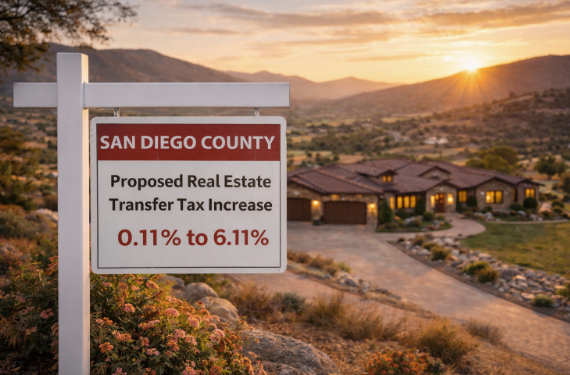

In San Diego County, the current county-level real estate transfer tax is 0.11% of the property’s sale price, or approximately $1.10 per $1,000 of value. This tax is separate from any city-imposed transfer taxes and other closing costs.

What Is Being Proposed in San Diego County?

The San Diego County Board of Supervisors has taken initial steps to explore legislation that would allow the county to raise its real estate transfer tax rate.

Under early proposals discussed publicly, the county’s transfer tax could increase from 0.11% to as much as 6.11%, pending authorization from the California State Legislature and subsequent local approval.

If implemented at the higher end of that range, a home sale priced at $1,000,000 could trigger a transfer tax exceeding $60,000 at the county level alone.

At this stage, the proposal is not yet law, and additional legislative steps would be required before any change could take effect.

Why Legislative Approval Is Required

California law limits the ability of counties to impose or increase real estate transfer taxes without authorization from the state legislature. To move forward, San Diego County would need:

Approval from the California Legislature

Enabling authority that allows a higher tax rate

Potential voter approval, depending on how the tax is structured

Until those steps occur, the existing transfer tax rate remains in effect.

How Would a Higher Transfer Tax Affect Home Sellers?

A higher real estate transfer tax would increase the total cost of selling a home. Because transfer taxes are calculated as a percentage of the sale price, higher-priced homes would experience larger dollar impacts.

Importantly, transfer taxes are owed regardless of whether the seller realizes a profit or loss on the sale. This means the tax would apply even in situations such as:

Downsizing or relocating after retirement

Selling due to job changes

Selling inherited property

Selling during market downturns

For homeowners in rural and semi-rural areas like Jamul, where properties often have higher price points due to land size and acreage, the financial impact could be more pronounced.

Potential Implications for the Housing Market

Economists and housing analysts often evaluate transfer taxes based on their effects on transaction activity. Because transfer taxes are triggered only when a property is sold, higher rates can influence homeowner decisions about whether and when to move.

Possible market considerations include:

Reduced home sale activity if sellers delay moving

Fewer listings entering the market

Increased cost calculations for buyers and sellers during negotiations

Potential downward pressure on net proceeds for sellers

The full impact would depend on final tax structure, exemptions (if any), and broader economic conditions at the time of implementation.

How This Relates to Jamul and East County San Diego

Jamul and surrounding East County communities are characterized by:

Larger lot sizes and acreage

Custom and non-tract homes

Higher variability in pricing compared to suburban neighborhoods

Because transfer taxes scale with price, sellers of acreage and rural properties could see higher absolute costs even if price per square foot is lower than urban areas.

For Jamul homeowners, understanding transaction costs in advance becomes especially important when planning a move, downsizing, or long-term financial strategy.

Relationship to Other State-Level Tax Discussions

The transfer tax discussion at the county level is occurring alongside broader conversations in California about revenue generation, wealth taxation, and funding for public programs.

Separately proposed measures, including potential state-level taxes on high-net-worth individuals, would operate independently from county real estate transfer taxes. However, both discussions highlight the importance of understanding how policy changes can affect real estate decisions.

What Homeowners Should Do Now

At this time, no changes to the San Diego County real estate transfer tax have been finalized. However, homeowners considering selling in the future may want to:

Monitor local and state legislative updates

Understand current closing costs and how they are calculated

Factor potential policy changes into long-term planning

Work with local real estate professionals who stay informed on regulatory developments

Having accurate, up-to-date information allows homeowners to make informed decisions without reacting to speculation or incomplete details.

The Importance of Local Market Knowledge

Real estate policy changes often affect communities differently based on property types, price ranges, and buyer behavior. In markets like Jamul, where properties do not follow uniform pricing models, understanding how taxes interact with land value and market demand is critical.

Local real estate professionals who specialize in Jamul and East County San Diego can help homeowners interpret how proposed policies may relate to their specific property and timing.

Summary: What This Means for San Diego County Homeowners

San Diego County is exploring a potential increase to its real estate transfer tax

The proposed increase would require state approval and possibly voter authorization

No changes are currently in effect

Higher transfer taxes would increase the cost of selling a home

Jamul homeowners may experience larger dollar impacts due to property values and land characteristics

Staying informed is the best way to navigate potential changes. As with any policy proposal, details matter, and outcomes depend on how legislation ultimately unfolds.