If you’ve been thinking about buying a home but feel nervous about the economy, you’re not alone. Headlines have a way of stirring up fear, and lately you may have noticed one theme over and over: “A recession is coming.” It’s everywhere — social media, news alerts, and conversations at work.

But here’s something most people don’t realize.

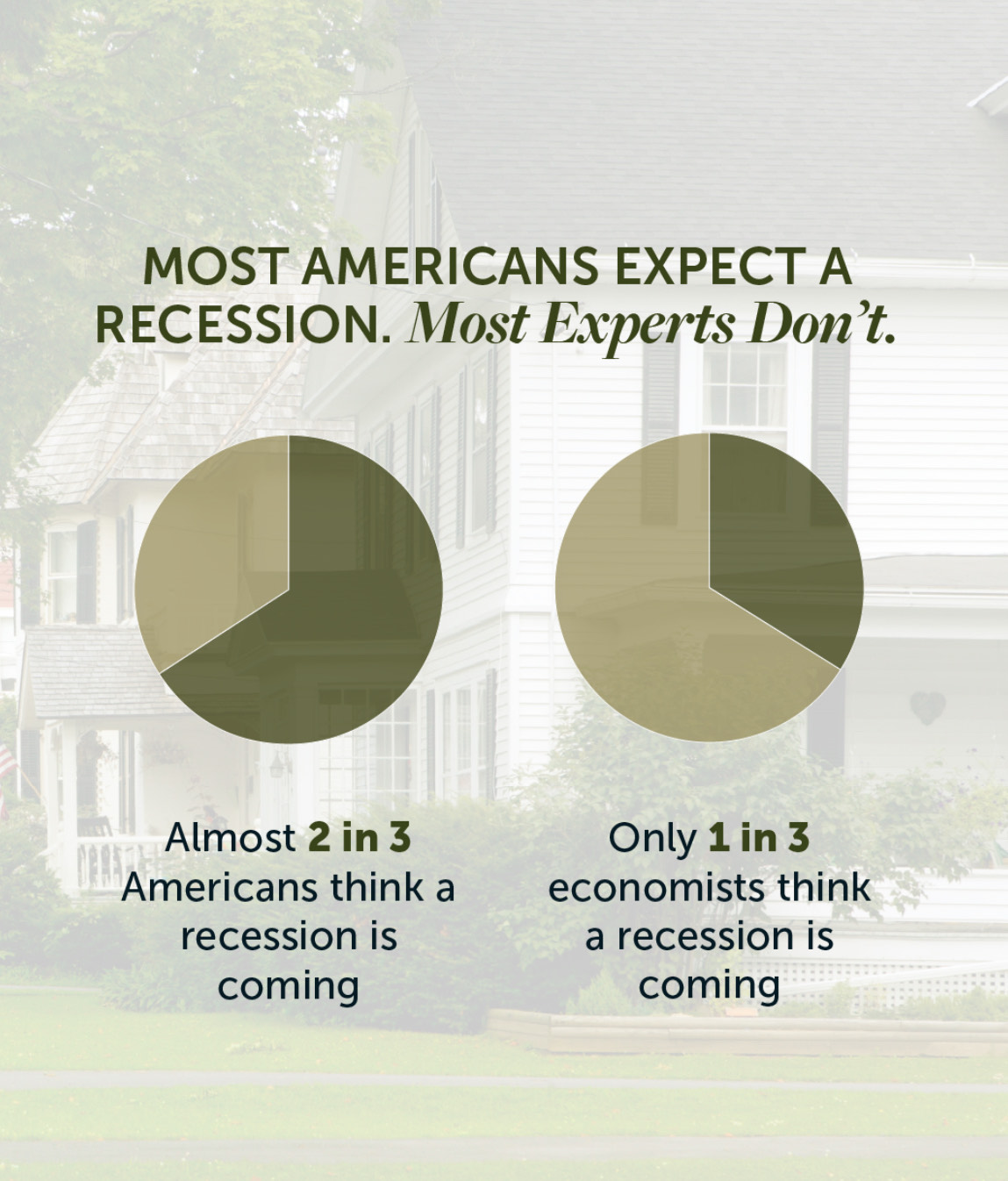

Two-thirds of Americans believe a recession is on the horizon. Only one-third of economists agree.

That disconnect is huge. And it tells us something important. Public fear does not equal economic reality. Most people are bracing for something that experts do not actually expect to happen.

The truth is simple.

We are not in a recession right now. And there is no guarantee that one is coming.

Yes, the economy shifts. Yes, markets cycle. But letting fear-driven headlines dictate your homebuying decisions could keep you from moving into a home that better fits your life.

If your job is stable, your finances are strong, and you’re ready for a change, you do not necessarily need to wait. In many cases, waiting out of fear could delay your next chapter for no reason at all.

This guide breaks down what buyers in Jamul, Rancho San Diego, La Mesa, Alpine, and the rest of East County San Diego need to know before pressing pause on their plans.

Why the Recession Headlines Feel So Loud

Over the last few years, Americans have lived through dramatic swings in the housing market, interest rates, inflation, and overall economic headlines. These experiences shape how people feel today.

Here’s why recession fears are so widespread:

• News outlets profit from dramatic headlines

• Social media amplifies worst-case scenarios

• People compare today to the 2008 crash

• Economic data is complicated and easy to misunderstand

• Inflation fatigue makes people anxious

• Change always feels risky

But the reality behind the data is calmer than the headlines suggest.

What Economists Actually Say

While two-thirds of the public expects a recession, most economists don’t see the same risk — at least not in the way people imagine.

Current data shows:

• Job growth remains strong

• Consumer spending is steady

• Home values are holding

• Mortgage rates are stabilizing

• No broad economic collapse signals are present

• Major indicators do not resemble 2008

Economists look at long-term patterns, not emotional reactions. And the majority do not believe a recession is likely in the near future.

Why This Matters for Homebuyers

Many buyers think, “I’ll wait for prices to crash. I’ll wait for everything to get cheaper.”

But the market today does not reflect recession behavior. And waiting for something that may not happen can cost you time, opportunity, and peace of mind.

Here’s what buyers need to understand.

1. You could be waiting for no reason

If a recession never comes, you postpone your dream home out of fear.

2. Home prices in East County rarely “crash”

Jamul, Rancho San Diego, La Mesa, and Alpine are supply-limited areas. Inventory is tight, and demand stays steady because people want:

• Larger lots

• Single stories

• Space

• Privacy

• Good school districts

• Proximity to nature

• Easy freeway access

These markets historically hold value better than others.

3. Interest rates fluctuate, but time can work against you

Rates may go up, down, or sideways. Waiting out of fear does not guarantee a better financial position later.

4. Rents are not getting cheaper

While you wait, rent increases and inflation continue.

5. Your life may need a change now

People move for real reasons:

• More space

• Downsizing

• Job changes

• Family needs

• Lifestyle upgrades

• Health considerations

Fear should not override genuine needs.

When It Makes Sense to Move Forward

You do not need to buy a home because the market is perfect. You buy because the timing is right for you.

If these statements are true for you, you may be more ready than you think.

Your job is stable

A steady income gives you a strong foundation.

Your savings are solid

You have enough for a down payment, closing costs, and a safety cushion.

Your monthly budget allows for a mortgage

Affordability matters more than headlines.

You’re tired of renting

Every rent payment is money you never get back.

Your current home no longer fits your lifestyle

Life changes should take priority over fear-based delay.

You want stability instead of uncertainty

Homeownership builds long-term security that waiting will not provide.

Why Fear-Based Decisions Hurt Buyers

Fear is one of the biggest barriers in real estate. It causes buyers to:

• Delay moves

• Overanalyze

• Miss opportunities

• Watch the perfect home go to someone else

• Try to “time the market” instead of making real progress

Nearly every buyer who waits because of fear eventually says the same thing:

“I should have bought sooner.”

The goal is not to be reckless. The goal is not to ignore risk. The goal is to make decisions based on real data, not headlines designed to scare you.

What Happens If You Wait Too Long

Waiting for a recession can backfire in several ways.

1. You may miss your ideal home

Inventory is finally rising in East County. More choices are available today than in the last five years.

2. Prices may continue rising slowly

East County’s limited land and strong demand make true price drops rare.

3. Interest rates could dip — but prices may rise with them

Even if rates fall later, increased buyer demand pushes prices up, canceling out any savings.

4. Your life does not pause

Your housing needs will keep evolving, recession or not.

5. Regret builds

People rarely regret buying the right home. They regret waiting.

What the Local East County Market Shows Us

Each East County community behaves differently, but they all share one pattern: steady long-term demand.

Jamul

Buyers want privacy, usable acreage, views, and custom homes. Supply is limited.

Rancho San Diego

Family-friendly neighborhoods with great schools continue to attract steady buyer interest.

La Mesa

Walkability, charm, and older architecture make La Mesa resilient in all markets.

Alpine

Buyers seeking space and quiet consistently look here.

Every one of these communities maintains strong appeal regardless of economic predictions.

How to Buy Confidently Even When the Headlines Feel Scary

Buying a home is a major decision, but there are smart ways to move forward without letting fear control the process.

1. Know your numbers

Get preapproved. Understand your buying power. Clarity removes anxiety.

2. Focus on your long-term goals

Think five to ten years, not five to ten headlines.

3. Understand local market behavior

National headlines do not reflect what happens in Jamul or Rancho San Diego.

4. Work with an agent who understands shifts

You deserve guidance rooted in real strategy, not hype.

5. Buy for your life, not someone else’s prediction

The right time to buy is when your life says it’s time.

You Do Not Have To Wait for the Perfect Market

If your finances are solid and your job is stable, you do not need to wait for a recession that may never come. Stability in your own life matters more than economic speculation.

You deserve a home that fits your needs, your future, and your lifestyle. Whether you want more space, fewer stairs, a bigger yard, a shorter commute, or simply a fresh start, there is no reason to let fear keep you from moving forward.

If You’re Thinking About Buying, Let’s Talk Through Your Options

My role is to help you make informed, confident decisions that support your long-term goals — not decisions based on fear or headlines. If you want clarity about the East County market or want help deciding whether now is the right time for you, I’m here to help.